This is an archived article and the information in the article may be outdated. Please look at the time stamp on the story to see when it was last updated.

SARASOTA, Fla. (SNN TV) — The time for you to resume repaying your student loans is soon.

“October is right around the corner when those payments are due,” said Leslie Tayne, founder and managing director of the Tayne Law Group.

After three years of holds, repayments begin again in a couple of weeks, but not without some changes. After student loan payments were paused under the 2020 CARES Act and continued under President Biden, student loans are now set to continue in October.

But with the new SAVE plan created by Biden’s Department of Education, Leslie Tayne of Tayne Law Group said many borrowers will see big shifts in what they’re paying.

“It could give you the opportunity to not only reduce the payments significantly but even get them down to zero,” Tayne said.

The new plan is geared toward lower and middle-income borrowers. The income exemption increased from 150% to 225% above the poverty line. What does that mean?

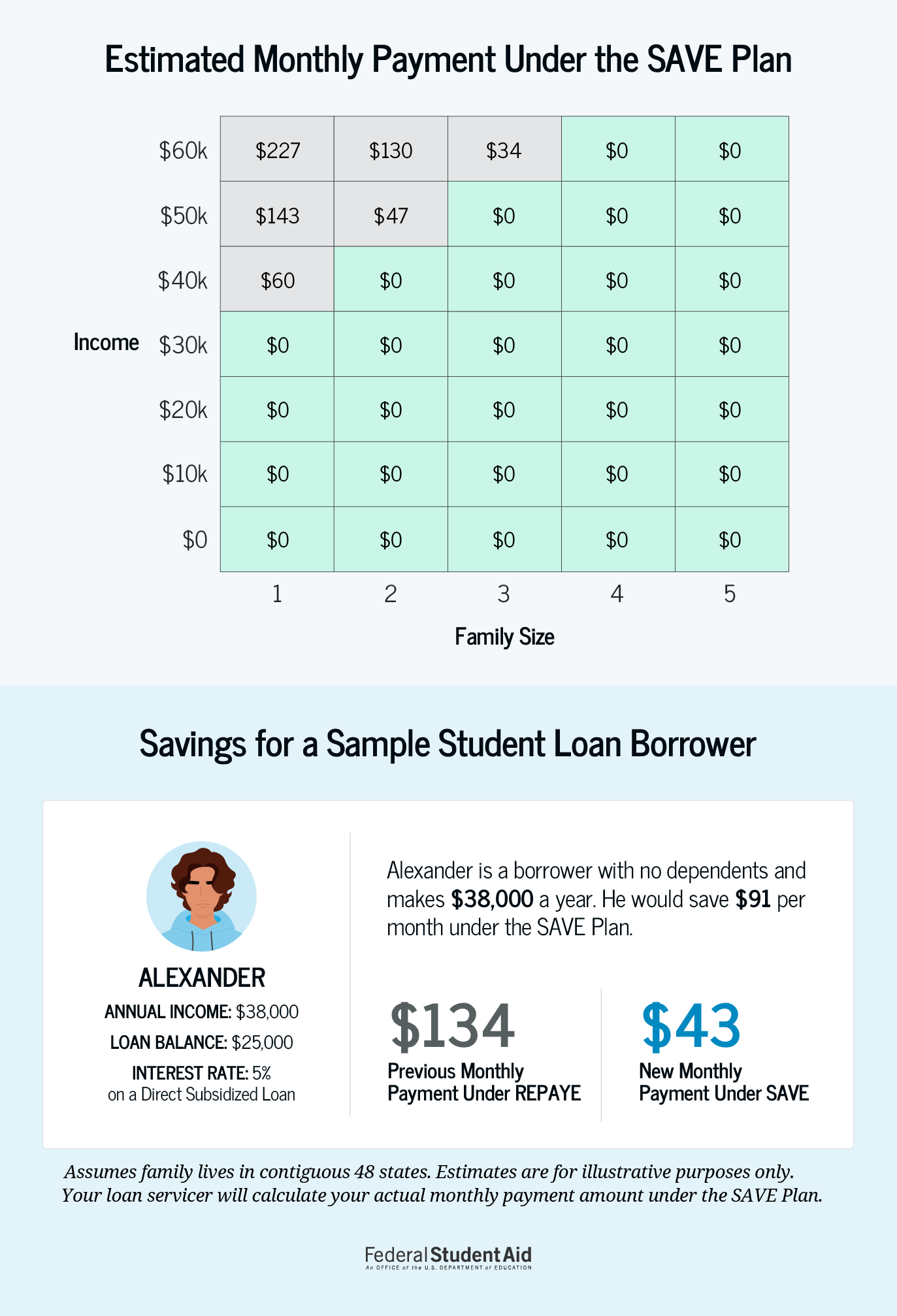

It means if you make $50,000 a year and you’re in a family of two, you could pay $47 a month. The bigger the family, the lower the payment.

However, if you’re of high income, you’re not likely to see as big of a savings. Those making $60,000 living alone would make an estimated payment of $227 a month.

Other changes under the SAVE plan include spousal income now being excluded if you’re married and file separately. Also, on July 2024, payments on undergraduate loans will decrease from 10% to 5% of income above 225% of the poverty line.